salt tax deduction california

Californias average SALT bill is the third-highest in the US. Since the passing of the TCJA you can only deduct 10000 effectively losing a deduction 12000.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000.

. But you must itemize in order to deduct state and local taxes on your federal income tax return. Then in December 2017 The Tax Cuts and. Rosenthal JD and Krista Schipp CPA.

1 The cap on SALT deductions applies for tax. 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A. High income tax rate.

California Governor Gavin Newsom signed Assembly Bill 150 on July 16 2021 incorporating a state and local tax SALT workaround through an elective 93 tax for pass. This is due to the states. California has joined the ranks of states who have developed a way to circumvent the 10000 federal deduction limitation state and local taxes.

Adding the 10000 cap increases the payment of an average. While AB-150s elective tax work-around appears quite favorable to California residents the devil is always in the details which we address below. That households so high on the income spectrum can expect a net tax cut from the Build Back Better Act is entirely due to the increase in the SALT deduction cap from.

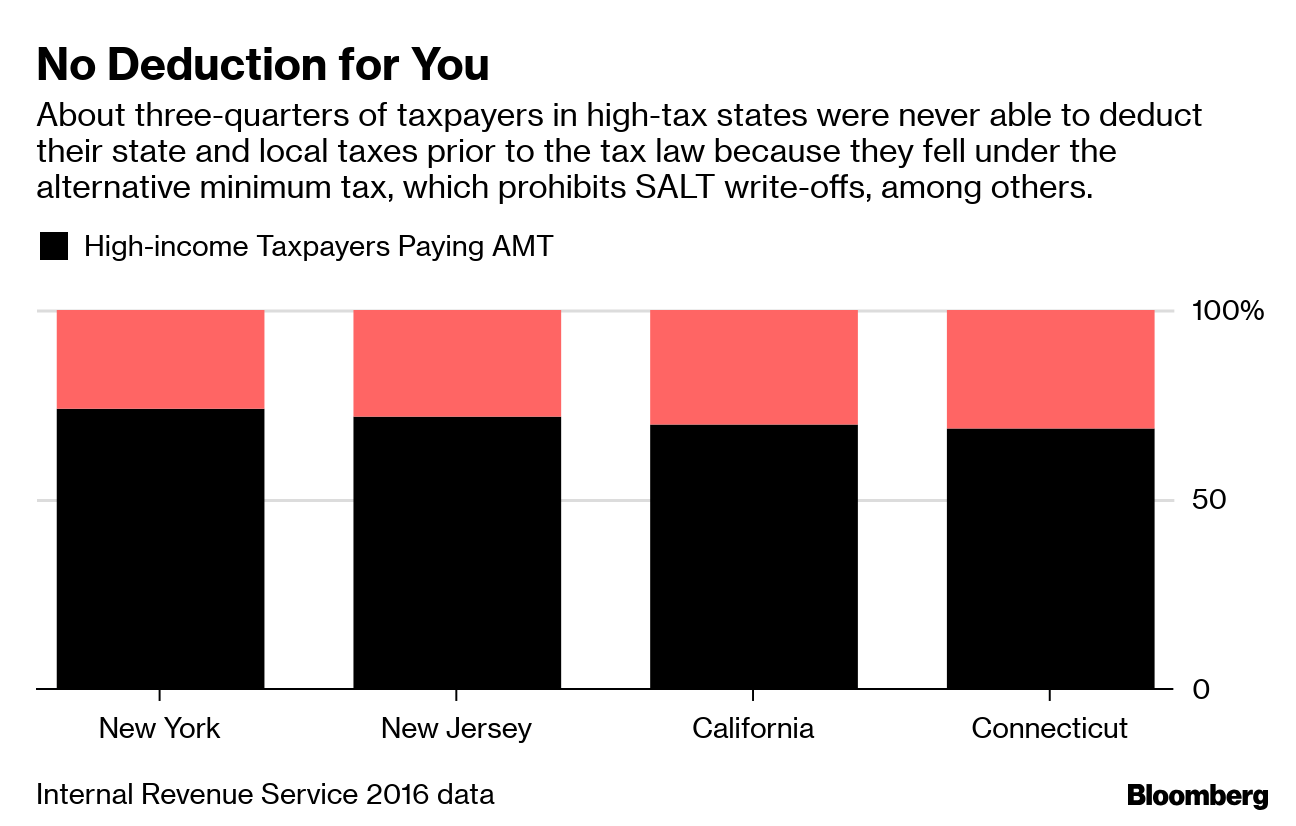

The TCJA added in IRC Section 164b6 effectively placing a 10000 cap on taxpayers federal itemized SALT deductions. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. The Washington-based Institute on Taxation and Economic.

Second the 2017 law capped the SALT deduction at 10000 5000 if. For your 2021 taxes which youll file in 2022 you can only itemize when your. In July of 2021 Governor Newsom signed California Assembly Bill 150 into law which.

Second the 2017 law capped the SALT. California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized deduction limit imposed by the 2017 tax reform that adopted. The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California.

The California Franchise Tax Board reported that in the 2018 tax year the SALT cap cost Californians 12 billion. The federal tax reform law passed on Dec. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump. By Corey L. California Governor Gavin Newsom recently signed Assembly Bill 150 AB150 which created a workaround for the.

California Enacts SALT Workaround. On January 05 2021 the California State Senate introduced significant legislation in Senate Bill 104 SB104 that if passed could provide a workaround for owners in pass. The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California.

The Deduction For State And Local Taxes The New York Times

California S Pass Through Entity Tax Election Providing Relief From The Salt Deduction Cap

Many Rich Fretting About Salt Didn T Get Break Before Trump Law Bloomberg

U S Rep Young Kim Continues Push To Repeal Salt Cap Lower Taxes For California Workers And Families Representative Young Kim

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Salt Cap Repeal Salt Deduction And Who Benefits From It

Salt Cap Workaround What You Need To Know Paragon Accountants

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

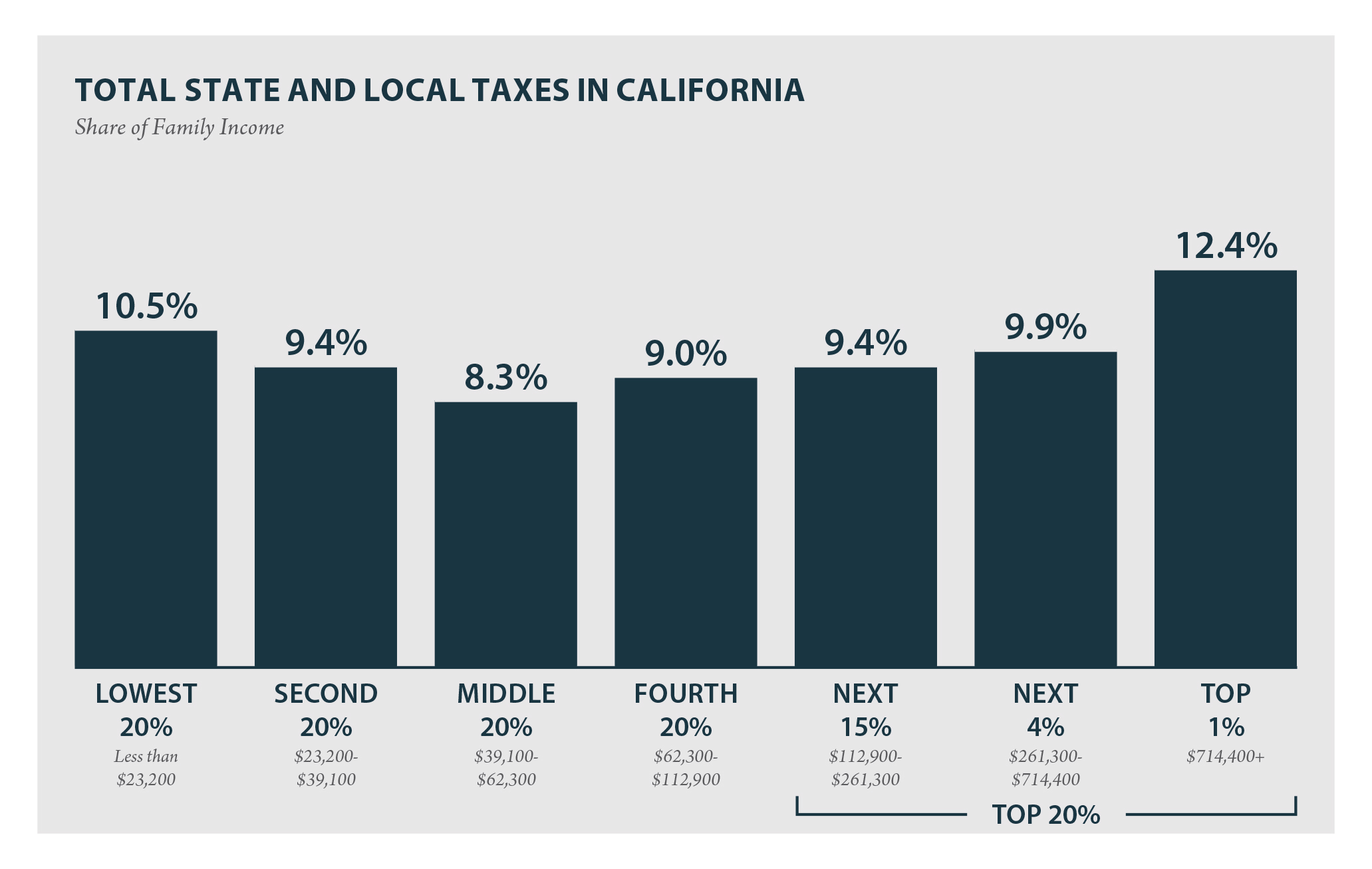

California Who Pays 6th Edition Itep

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

These States Offer A Workaround For The Salt Deduction Limit

Testimony California S Salt Deduction Cap Workaround Tax Foundation

A Slice Of Build Back Better Could Lower Taxes For Many In Southern California Orange County Register

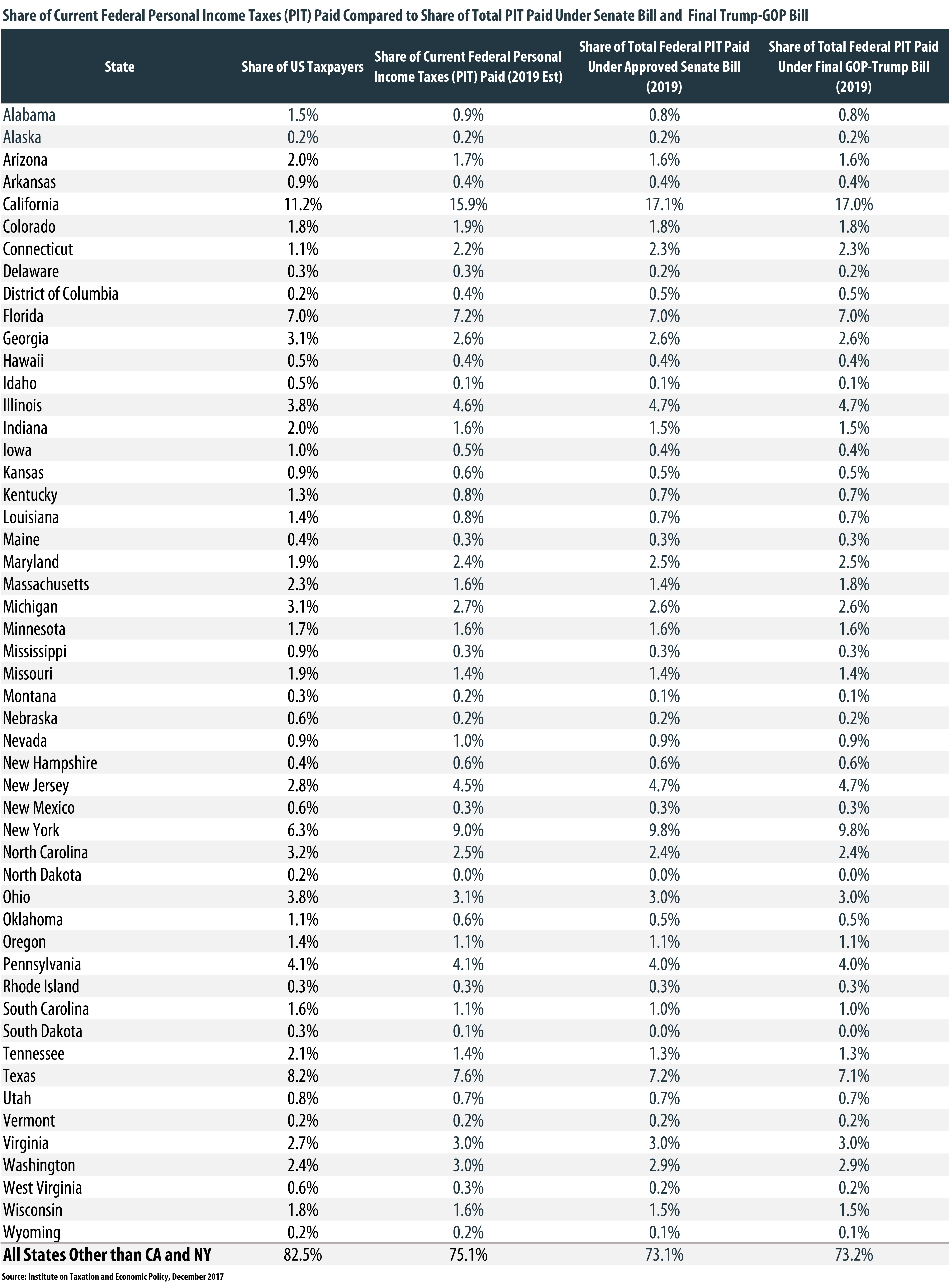

Final Gop Trump Bill Still Forces California And New York To Shoulder A Larger Share Of Federal Taxes Under Final Gop Trump Tax Bill Texas Florida And Other States Will Pay Less Itep

Why A 10 000 Tax Deduction Could Hold Up Trillions In Stimulus Funds The New York Times

Congress Might Eliminate California State And Local Tax Deductions Here S A Look At The Numbers Pasadena Star News